Why Gold and Silver Prices Rose Sharply in 2025 and the Way Forward

Gold & Silver Prices Surge in 2025 – Outlook for 2026

Introduction

Gold and silver have always been more than just commodities—they are symbols of wealth, security, and resilience. In 2025, both metals experienced a dramatic surge, catching the attention of investors, central banks, and everyday savers alike. Gold climbed to record highs, while silver outpaced expectations with its dual role as both a safe-haven and an industrial metal. But what triggered this rally, and what lies ahead in 2026?

Why Gold and Silver Prices Rose Sharply in 2025

1. Global Economic Uncertainty

The year 2025 was marked by trade tensions, inflationary pressures, and slowing global growth. Investors sought refuge in assets that could withstand volatility, and gold naturally became the preferred hedge. Silver, riding on similar sentiment, benefited from its affordability compared to gold.

2. Weakening US Dollar

A softer dollar made precious metals more attractive worldwide. As the dollar depreciated, central banks diversified reserves, increasing gold purchases. This trend amplified demand and pushed prices higher.

3. Geopolitical Tensions

Conflicts in Eastern Europe and the Middle East created waves of uncertainty. Safe-haven demand surged as investors feared escalation, driving gold and silver prices upward.

4. Industrial Demand for Silver

Silver’s rally was not just about fear—it was about innovation. With the global push toward renewable energy, silver became indispensable in solar panels, electric vehicles, and electronics. This industrial demand gave silver an edge over gold, making its rally sharper.

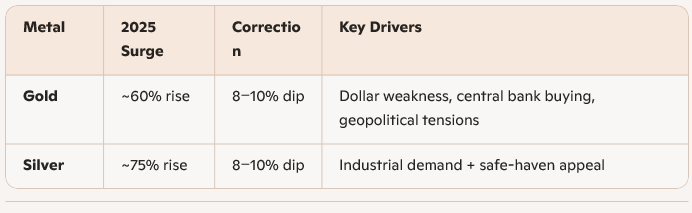

Correction Phase in Late 2025

Despite the bullish run, October 2025 witnessed a correction of nearly 8–10% in both metals. Optimism around easing trade tensions and progress in peace talks temporarily reduced safe-haven demand. However, analysts viewed this dip as a healthy correction rather than a reversal.

Performance Snapshot

The Way Forward: Outlook for 2026

1. Safe-Haven Demand Will Persist

Global uncertainties are far from over. Inflationary pressures, currency risks, and unresolved trade disputes suggest that gold will remain a preferred hedge.

2. Volatility Ahead

Exchanges like CME have already raised margin requirements, triggering profit-booking. Investors should expect sharp swings, but the underlying trend remains supportive.

3. Silver’s Dual Role

Silver’s industrial demand will continue to grow, especially with the renewable energy transition. This makes silver more volatile but potentially more rewarding than gold.

4. Structural Factors Supporting Precious Metals

- Central banks diversifying away from the US dollar.

- Rising inflation across emerging economies.

- Increased retail participation through ETFs and bullion purchases.

Investment Strategy for 2026

- Diversify Holdings: Balance investments between gold and silver to hedge against volatility.

- Long-Term Perspective: Despite corrections, structural factors point to continued strength.

- Silver Advantage: Silver may outperform gold due to industrial demand.

- Risk Management: Staggered investments or SIPs in gold ETFs can reduce exposure to sharp corrections.

Conclusion

The surge in gold and silver prices in 2025 was fueled by a combination of economic uncertainty, geopolitical tensions, and industrial demand. While corrections are inevitable, the long-term outlook remains bullish, particularly for silver given its role in the green energy revolution. For investors, precious metals continue to be a reliable hedge against inflation, volatility, and currency risks